A car accident, a broken bone, a sick child . . . many things can land us in the hospital which can throw a wrench in your other plans. Requiring time to heal or care for a family member can mean lost time from work and a mountain of medical bills.

Being overwhelmed by medical bills is not only a burden and when one of those bills makes it way over to your credit report it can haunt you for years to come. So the question is, do lenders weigh medical bills as heavily as they do other types of debt? And how exactly do medical bills affect your credit?

Medical Bills In Collection

Your doctor’s office or hospital has a billing department (or sometimes an outsourced billing department) that is responsible for calculating the difference between what insurance covers and the amount that you owe out of pocket. Most of the time, they are more than willing to set up a payment plan for their patients because after all, it is better for them to receive 100% over time rather than a lesser percentage if they have to hand the accounts over to collection agencies.

Typically, it isn’t until your account goes to collections that it is reported to the credit reporting agencies. Once it is reported is when things start to get a little complicated because that is when it begins affecting your credit scores. One of the biggest factors in calculating credit scores is payment history and if you have late payments or missed payments, it is going to drag your scores down the fastest.

Affect On Your Credit Score

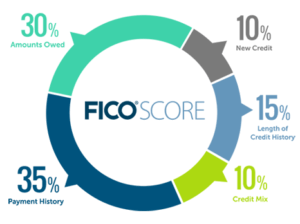

Medical bills that have entered collections will affect your credit score negatively. One look at the pie chart shows the amount you owe and your payment history can account for 65% of your credit score! In addition to a big hit to your score, medical bills in collection will take 7 years to drop off your credit report. By law, consumers are entitled to one free credit report a year from each of the three credit reporting agencies. Instead of paying for a credit monitoring service, pull a credit report from one agency every 4 months to keep tabs all year long by going here. Although you won’t be able to see your score, it will outline your lenders and your payment history.

Credit Score Changes

Most lenders use the credit scoring model by the Fair Isaac Corporation (commonly referred to as FICO) and in the past couple of years, FICO has developed a new scoring model. The new model is good news for those with medical debt in collections as scores will not be penalized as harshly. The major change is that past paid medical debts will not be factored into the new scores and unpaid debts will weigh less. So while medical debts reported to collection agencies still hurt you, they won’t hurt you as much as they did in the past. The bad news? Many lenders still have not implemented the version of the FICO scoring model.

Prevent Bills Going to Collections

If your doctor’s office is calling you to make a payment, chances are they haven’t sent these bills to collection yet. As mentioned previously, they are more willing to work with you making payments rather than having to sell these accounts to collection agencies. Set up a manageable payment plan and communicate with them. If you are going through a rough patch or unable to make a payment this month, they are likely to notate the account if you’re keeping them updated, making it less likely to go to collections. By consistently making payments, even if they’re willing to take a minuscule amount, will ensure you keep your credit in good shape and have more favorable credit terms elsewhere.