223 W Wall St #215 Midland, TX 79701 – (Get Directions?)

Beyond Balanced Financial Planning was founded to deliver real financial planning to regular people through a service model that actually makes sense. We serve families that seek to build healthier, more fulfilled lives by taking a values-based approach to building wealth. Financial independence is the goal so our clients can live life on their terms.

I’m the founder of Beyond Balanced Financial Planning, an independent fee-only practice dedicated to helping my clients gain clarity and achieve their financial goals. When I started this practice, my goal was to provide valuable advice in a holistic manner. I believe that we all have to start somewhere and overall financial wellness is what really matters.

Beyond Balanced simply means going beyond the balance sheet to live your life on your terms. We take the time to understand you, your situation, preferences, goals, and your personal money beliefs. There is no one-size-fits-all approach and we work together to design a plan tailored to your unique situation.

“Tell me, what is it that you plan to do with your one wild and precious life?”

– Mary Oliver

Discover Our Services

Financial Planning

A financial plan is unique to you, it is dynamic and always changing. We get a plan in place and help you implement recommended tasks, stay on course and serve as a sounding board for when those inevitable changes happen.

Investment Management

You are busy enough without having to worry about managing your investments. We invest using strategies that are rooted in academic evidence, not speculation. Portfolios are tailored to your goals and tolerance for risk.

Small Business Owners

If you’re a business owner, we can help you start a new retirement plan or refresh an old plan you have in place. Additionally, we offer educational seminars for employees so they can maximize their available benefits.

Money ≠ Happiness

We believe how you spend your time is more important than how you spend your money.

True wealth comes from spending your time in a way that is aligned with what is most important to you. No amount of money will replace the moments you miss with your kids or loved ones.

Experiences > Stuff

You will talk about your unique adventures for years to come because of the joy they brought. The other “stuff” is just forgotten about.

We believe experiences outweigh the (mostly) unnecessary things you buy. Don’t let mindless spending slow you down.

Giving To Others

Giving can take many forms: your time, your resources, your support, etc.

We believe giving not only feels good but many of us are driven to give for reasons beyond our own financial benefit. We’ll help you set up a strategy so you can give to the organizations that are most important to you.

Sign Up For Our Newsletter And Make Smarter Money Decisions

Stay informed with our newsletter and empower your financial choices. Get smarter money decisions delivered to your inbox.

The latest news, views, and more

Beyond the Numbers: The 5 Pillars That Define Our Financial Planning Approach

At Beyond Balanced Financial Planning, we understand that financial success isn't solely about numbers—it's about aligning your finances with your…

Navigating College Savings Accounts: What You Should Know

In this guide, we'll explore four key types of college savings accounts - UTMA accounts, 529 College Savings Plans, Coverdell…

Financial Planning Considerations for Single Individuals

If you are single (or recently single) in your prime earning years, you have planning needs that will differ from the needs…

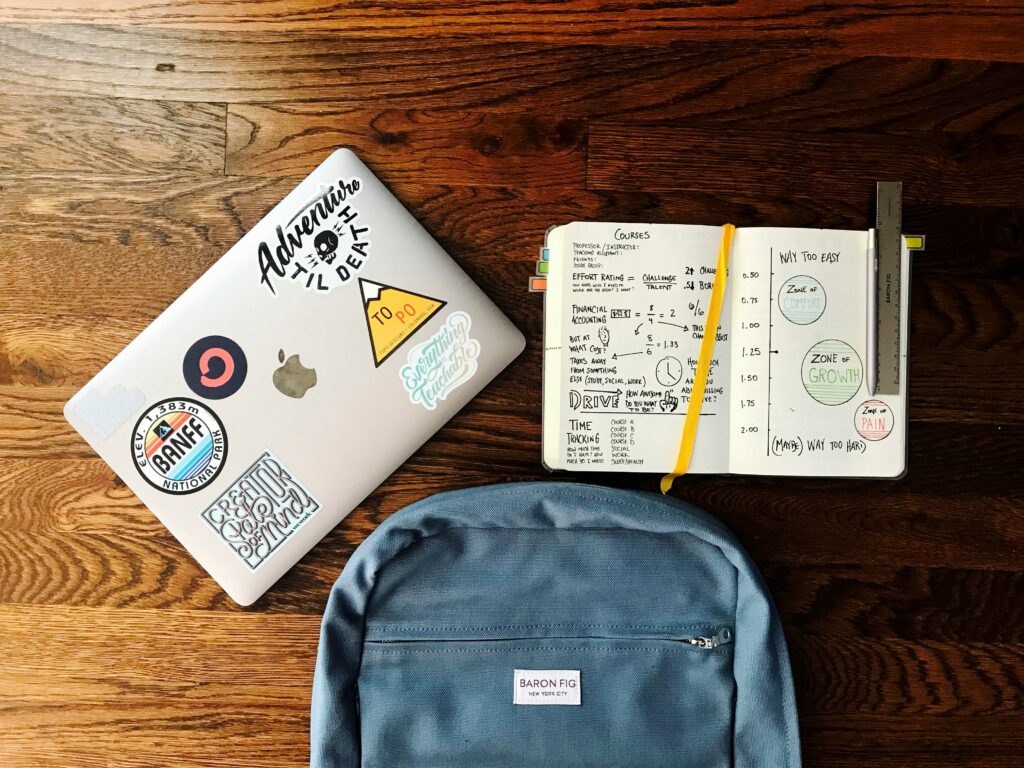

Get a Live Glimpse into Our World

Achieve Financial Freedom With Our Comprehensive Planning Services

Take the first step towards financial freedom with our holistic planning services, tailored to your unique goals and aspirations.